1099 Quickstart Guide

1. Sandbox Setup

Signing up to Sandbox is the fastest way to get up and running. Sandbox is a test account for you to set started quickly without doing KYC or processing real money.

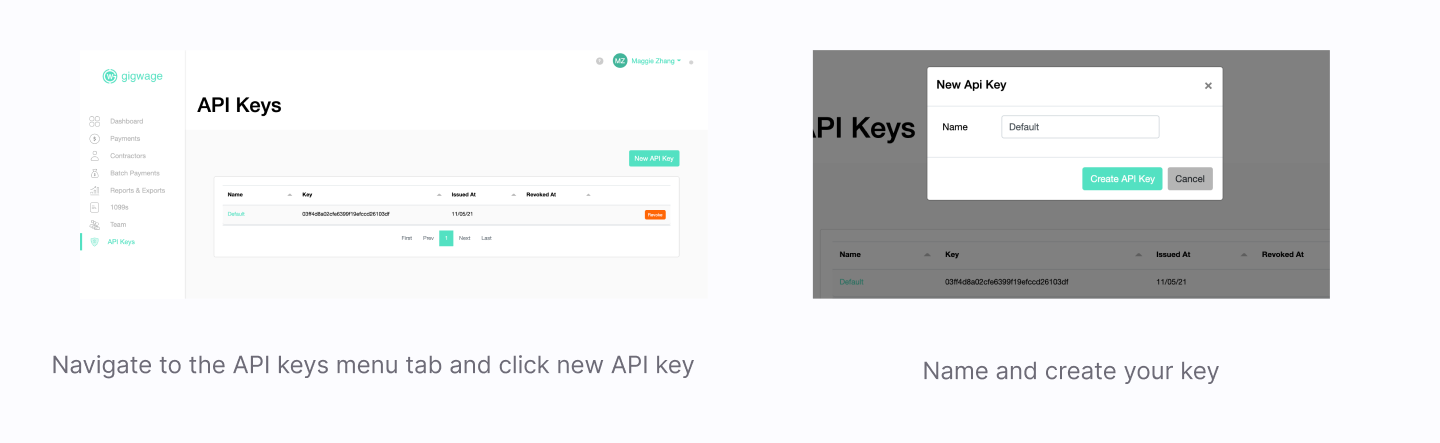

Create API Key

You can access the API key from the dashboard.

Production vs Sandbox

API keys are environment-specific, you will have a different API key for your Sandbox and Production instance. When you have thoroughly tested making payments on Sandbox, you are ready to use your production environment.

The base URL for the API depends on the environment:

- Sandbox: https://sandbox.gigwage.com/api/v1

- Production: https://www.gigwage.com/api/v1

2. Authentication

Add authentication headers to each API request.

request['X-Gw-Api-Key'] = api_key

request['X-Gw-Timestamp'] = timestamp

request['X-Gw-Signature'] = signature

var headers = {

"Content-Type": "application/json",

"Accept": "application/json",

"X-Gw-Api-Key": api_key,

"X-Gw-Timestamp": timestamp,

"X-Gw-Signature": signature

}

Go to the Authentication Summary to learn more about error responses.

3. Create recipient W-9 records

Maintain tax compliance by inserting W-9 collection into your workflow

A critical consideration is where to insert W-9 collection into your workflow. Gig Wage strongly recommends building W-9 collection and instant TIN validation into your recipient record creation process to avoid potentially being subject to backup withholding. Missing or incorrect TINs require you to withhold taxes (24% of payments) as well as issue B-notices to your recipients

Collecting W-9 information

You will need to collect W-9 information from your contractors. The fields you need to collect and submit can be found on Submit W-9 information.

Digital 1099 Consent

You need to collect recipient consent for accepting digital delivery of the 1099 if you want to only issue digital 1099s and forgo paper delivery. We recommend including the following language for the digital consent:

Example Consent

By using [Company's] services you agree to and understand the following:

You are opting in to receiving an electronic copy of your 1099 form.

This consent to receive an electronic 1099 will remain in place so long as you do not opt out.

Any electronic 1099s made available to you will remain available indefinitely until you request that your account be closed and/or deleted.

Digital W-9 Alternative Consent

When capturing the W-9 data from your 1099 recipient you will need to present the following disclosures in your application for the form to serve as an acceptable digital W-9 alternative.

The IRS requires a digital W-9 alternative to display certification language similar to what's shown on the official Form W-9:

Example Consent

By using [Company's] services you agree that the information provided for Form W-9 is accurate and that you certify the provided information as follows:

"I certify, under penalty of perjury that:

Taxpayer Identification Number or Social Security Number I provided is correct;

I am not subject to backup withholding because: (a) I am exempt from backup withholding, or (b) I have not been notified by the Internal Revenue Service (IRS) that I am subject to backup withholding as a result of a failure to report all interest or dividends, or (c) the IRS has notified me that I am no longer subject to backup withholding; and

I am a U.S. citizen or other U.S. person; and

The FATCA code(s) entered (if any) indicating that I am exempt from FATCA reporting is correct.The Internal Revenue Service does not require your consent to any provision of this document other than the certifications required to avoid backup withholding."

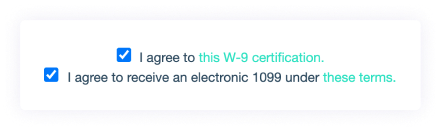

Consent UX

Here is an example of how Gig Wage includes digital 1099 consent and W-9 certification into the recipient onboarding/W-9 capture workflow.

Consent language opens up in corresponding modals

Storing W-9 records

Gig Wage stores your W-9 records for you. To access W-9 records at any time, use Show W-9 information.

4. Creating and Filing 1099s

Gig Wage files both your state and federal 1099s.

Types of supported 1099s

1099-K: Payment facilitators

1099-NEC: Non-employee compensation

1099-Misc: Various types of income, prizes, awards, or gross proceeds

Creating a draft 1099

To create a draft 1099, call Create 1099. You'll need the contractor ID provided by Submit W-9 information.

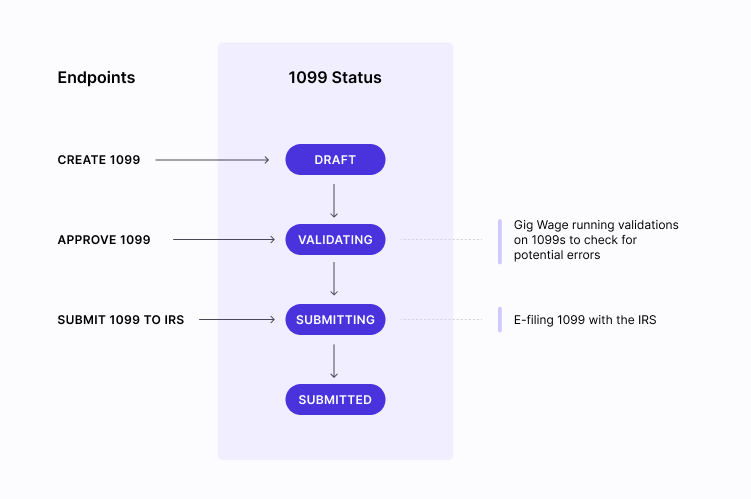

E-filing a 1099

Below is the process to e-file once you've created the draft 1099.

Delivering your 1099

If your recipient consented to a digital 1099, you can deliver your 1099 with Get 1099 PDF URL. This will provide a link to the pdf of your recipients' 1099.

If your recipient needs a paper 1099, Gig Wage mails the recipient their paper 1099.

Storing your 1099 records

Gig Wage will continue to store your recipient's 1099 for your records. You can access 1099 records at any time using Get 1099 PDF URL

5. Webhooks

You can subscribe to webhooks to get updates about:

- 1099 statuses

- TIN checks

Updated almost 4 years ago